Published: August 29, 2024 at 4:15 pm

Updated on January 23, 2025 at 2:45 pm

Do you want to secure your trades and maximize profits? Cryptorobotics provides a solution with automated tools — Stop Loss, Take Profit, and Trailing Stop.

With Cryptorobotics, risk and profit management becomes simple and effective. Allow your trades to grow securely and maximize profit using cutting-edge cryptocurrency trading tools.

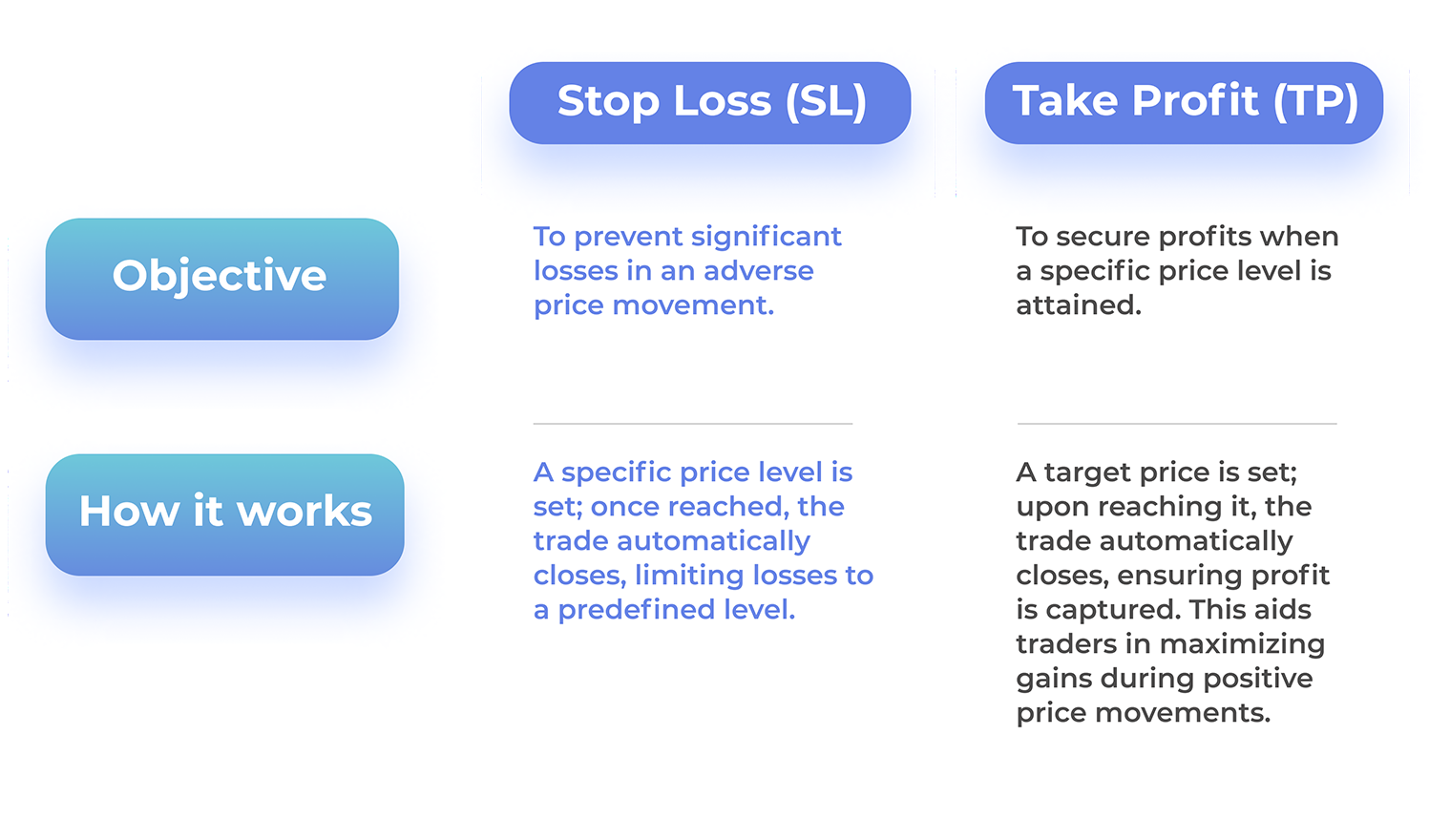

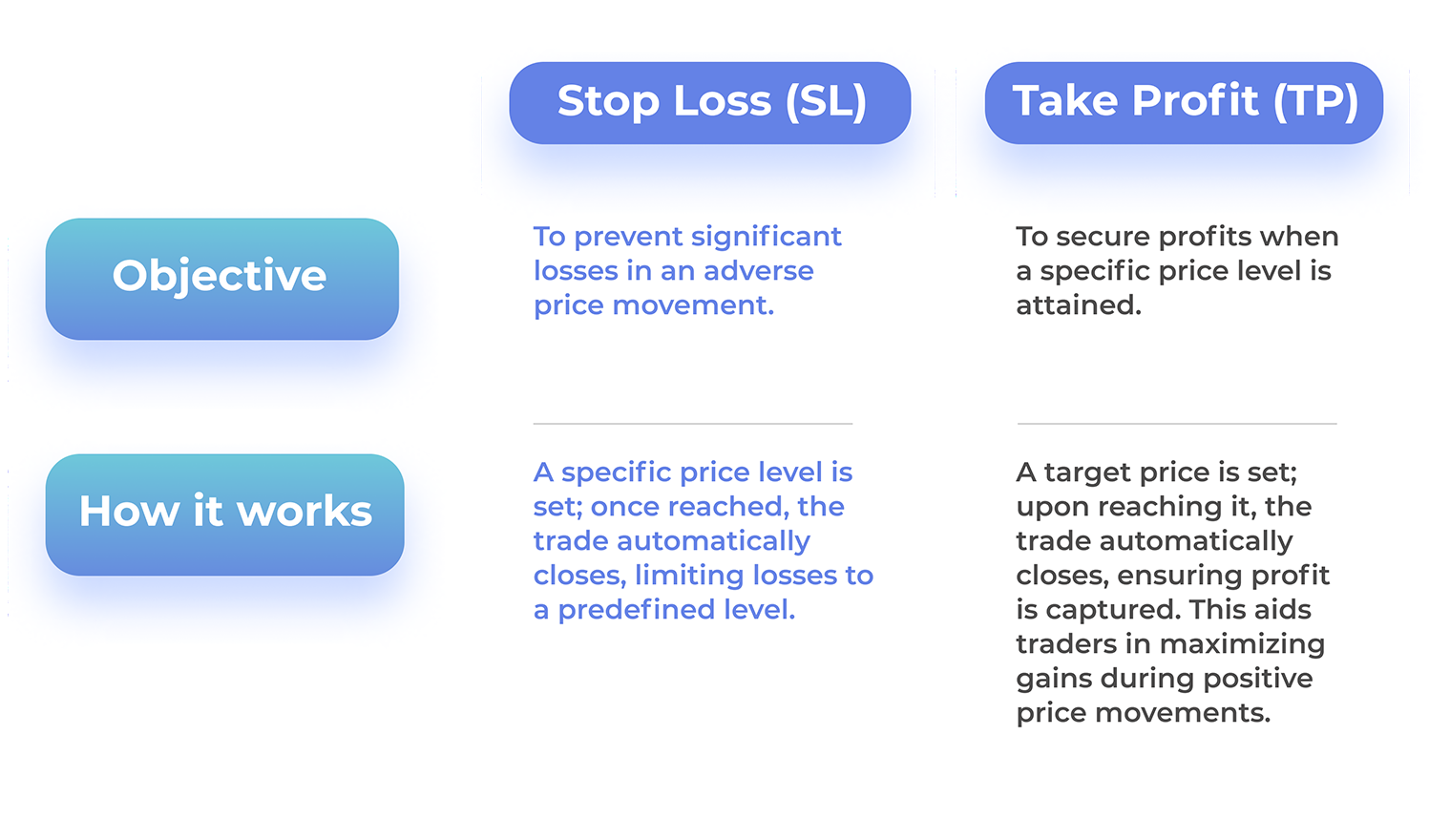

Stop Loss (SL) and Take Profit (TP) are critical tools in risk management during trading. CryptoRobotics allows the use of them on multiple crypto exchanges via a single interface.

Set Trailing Stop for both Take Profit and Stop Loss and get a more efficient result in crypto trading. Start earning more with Trailing Stop Loss and Trailing Take Profit!

Trailing is a stop order that can be set to fix a percentage or number of coins at a lower or higher current market value of an asset. This tool can minimize the loss of funds and maximize profits.

Trailing Take Profit is a feature that allows traders to continue making profits when a specified level is reached in case the value of an asset continues to rise. To set this feature, the trader must specify the distance between Trailing and Take Profit as a percentage. Thus, if the value of the coin grows, Trailing will move the Take Profit level higher, taking into account the specified distance. If the value of the coin starts to decrease and reaches the specified percentage distance, the trade will be automatically closed. But, if the price does not drop to the specified value and goes up, then Trailing will continue to move the Take Profit.

A Trailing Stop Loss is a feature that automatically moves the Stop Loss level up and is designed to be used in a rising market. To start using it, traders also need to specify the distance as a percentage. If the value of the digital asset starts to decline, the trade will automatically close at the price level that Trailing moved it to.

Implementing Take Profit and Stop Loss strategies in trading offers several key advantages:

What is a stop-loss?

A stop-loss is an order placed with a broker to buy or sell once the coin reaches a certain price, designed to limit an investor’s loss.

What is a 20% stop-loss?

A 20% stop-loss is a strategy where a trade is automatically closed if the asset’s value drops by 20%, limiting potential losses.

What is a good stop-loss?

A good stop-loss aligns with your risk tolerance and trading strategy, preventing excessive losses while allowing room for market fluctuations.

Is stop-loss a risk management?

Yes, stop-loss is a crucial component of risk management, helping traders control and limit potential losses in volatile markets.

What is an example of taking profit?

Taking profit involves selling an asset at a predetermined price to secure gains. For example, selling a cryptocurrency when it reaches a target price.

What happens when you take profit?

When you take a profit, the trade is closed automatically at the predetermined price, realizing the profits.

What is the profit-taking rule?

The profit-taking rule is a strategy where a trader sets a target price for selling an asset to secure profits and avoid potential market reversals.

What is take profit ratio?

Take profit ratio is the relationship between the desired profit and the initial risk in a trade, helping traders assess the potential reward against the risk involved.

Related Topics

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more