Published: August 31, 2024 at 9:53 am

Updated on December 10, 2024 at 7:31 pm

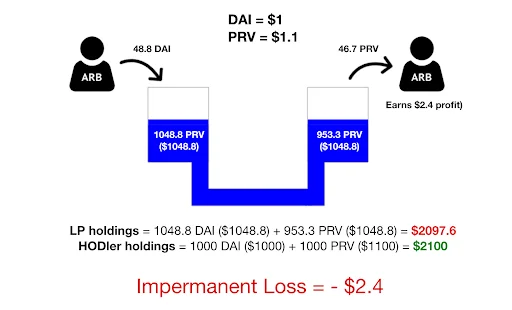

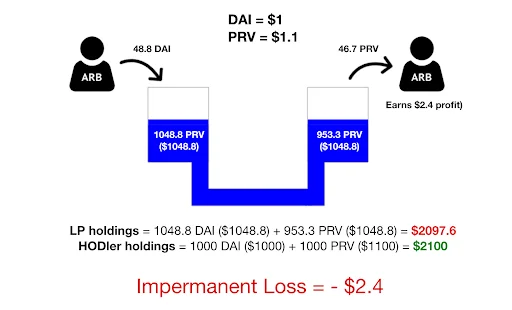

If you have ever worked with DeFi, you must have come across the concept of Impermanent Loss. An Impermanent Loss occurs when you provide liquidity to a pool and the price of your locked coin changes relative to another one since it was deposited. The larger this change, the more you are exposed to Impermanent Losses. In this case, the excessive volatility of the tokens deposited in the pool can lead to losses in dollar terms when withdrawing funds.

At the moment, many DeFi projects are experiencing a period of explosive growth. We are talking, for example, about such projects as Uniswap, SushiSwap, or PancakeSwap. With their help, anyone who has the funds can become a market maker and earn commissions by locking their assets into the liquidity pool. It does not require any specific knowledge, special equipment, or even large sums of money. However, this process has some advantages and disadvantages. One of them is impermanent losses.

Impermanent Loss (IL) is a temporary loss of funds sometimes experienced by liquidity providers for AMM due to the volatility of a trading pair. This indicator is expressed in dollars and shows the loss relative to the amount of the actual withdrawal, compared to the fact that the investor simply holds his assets.

Many people often interpret IL incorrectly, adding fees, spreads, and slippage to this value. But in fact, none of this affects IL. The impermanent loss is calculated using a well-defined formula and does not include incremental costs.

AMM is an autonomous decentralized exchange managed by software. The prices of assets held in AMM liquidity pools are controlled by an underlying algorithm. Liquidity is provided by liquidity providers (LPs), who usually contribute equal amounts of two assets to the pool. For example, it is ETH and DAI.

AMM was first described on Reddit by the founder of the Ethereum platform, Vitalik Buterin, as a way to simplify the creation of a market on smart contracts. In 2017, the first AMM Bancor appeared, and a year later, Uniswap appeared, which is currently considered the market leader.

Using automated exchanges, investors can deposit their coins into liquidity pools and in return receive rewards (in the form of fees charged from traders), which are calculated in proportion to the shares of the investment. Usually, LPs are also awarded project tokens, which give them the right to vote on decisions to make key changes to the protocol and act as a kind of project shares.

Thus, liquidity providers are interested in placing their assets in AMM, as they receive remuneration in the form of a commission from traders and project tokens. However, they may encounter Impermanent Loss, which poses a significant risk to their income.

The AMM protocols are managed by a mathematical algorithm that automatically balances the 50:50 asset ratio in the pool and thus determines their value. The formula X x Y = K is used as a pricing mechanism, where X and Y are different digital coins, and K is a constant value that should not change before and after the transaction.

This algorithm of operation allows the market to function autonomously, creates an opportunity for arbitrage, but also causes Impermanent Loss in DeFi. The key reason for the occurrence of an Impermanent Loss can be called the discrepancy between the value of coins in the liquidity pool of the real market situation.

One of the simplest and most effective ways to mitigate Impermanent Losses is to maintain liquidity in low volatility pairs. First of all, preference should be given to older and larger projects that already have their own formed price and are less subject to volatility. These include cryptocurrencies from the TOP-20 rating by capitalization.

Secondly, you need to choose pairs where the value of one asset relative to another remains relatively stable. For example, it can be paired with stablecoins. Another thing is that this option for investing is limited in terms of potential price growth.

Some special tools and platforms allow liquidity providers to mitigate Impermanent Losses. For example, the AMM Balancer protocol allows you to set individual proportions for liquidity pools with different pairs. Thus, liquidity providers can try to anticipate market movements and mitigate their potential Impermanent Losses if asset values change.

It is better to start investing in AMM in small amounts. Especially if you are just getting to know the market or trading pair. Small investments will help, with minimal risks, to assess in which direction the value can move and what real losses can be incurred.

Be sure to find a reliable and proven AMM platform. The DeFi space is now at its peak and anyone can fork an existing project, adding only minor changes to it. This can cause errors in the operation of the protocol and lead not to temporary, but to quite real losses.

Impermanent Loss is one of the main terms that liquidity providers should be familiar with. Many of the most popular AMMs, such as Uniswap, PancakeSwap, and others, have focused on ease of use without providing any mechanism to prevent Impermanent Losses. Therefore, investors should have a good understanding of what LP is, how losses are formed and how they can be prevented.

Related Topics

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more