Published: January 27, 2026 at 11:26 am

Updated on January 27, 2026 at 11:28 am

Token supply is one of the most frequently misunderstood concepts in the cryptocurrency market, despite being one of the most critical factors for valuation, market dynamics, and long-term investment analysis. Many investors focus almost exclusively on price charts while overlooking supply mechanics that directly influence scarcity, inflation, and market capitalization.

This article provides a comprehensive, technically accurate explanation of how token supply works, with a clear breakdown of circulating supply, total supply, and max supply. It is designed for readers who want to evaluate crypto assets professionally, avoid common analytical mistakes, and understand how supply structures affect price behavior over time.

In traditional finance, supply is relatively transparent. Shares outstanding, dilution schedules, and issuance policies are disclosed and regulated. In crypto, supply models vary widely, are often algorithmic, and can change depending on governance decisions, vesting rules, or smart contract logic.

Token supply directly impacts:

Ignoring supply metrics often leads to distorted conclusions, such as assuming a low token price means “cheap” or that price growth is inevitable once demand increases.

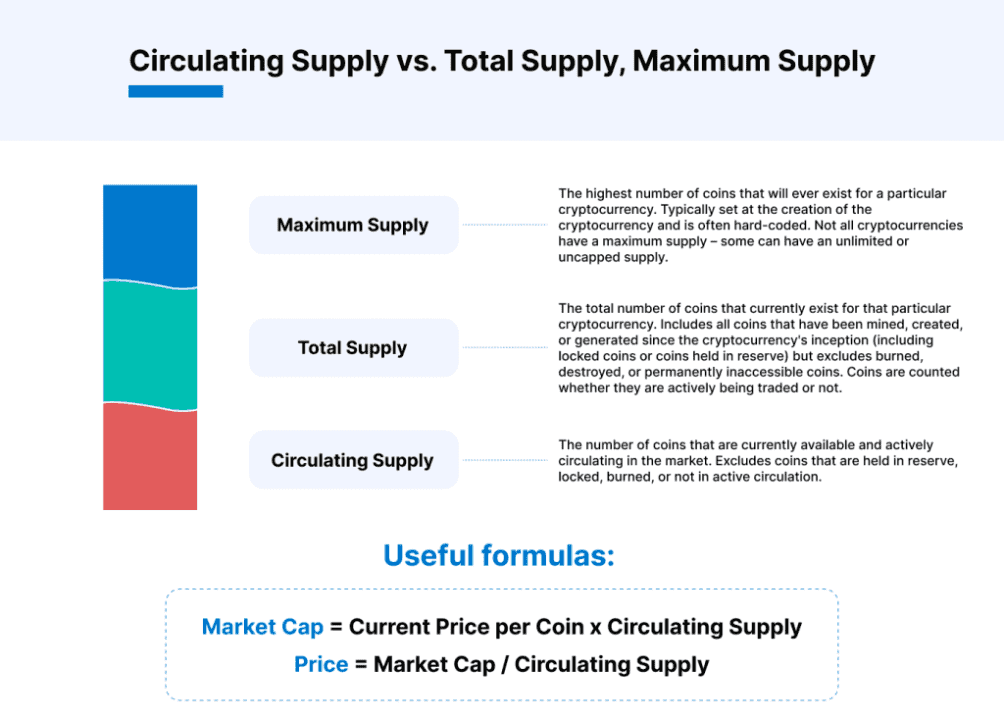

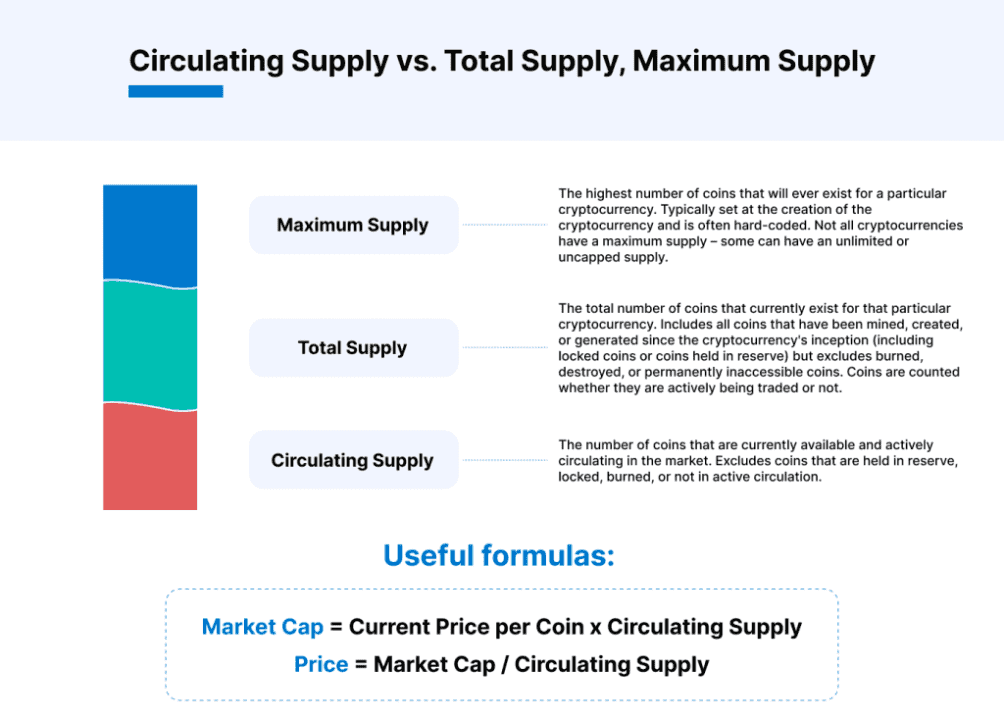

There are three primary supply metrics used across the crypto industry: circulating supply, total supply, and max supply. While they are related, each measures a different aspect of token availability.

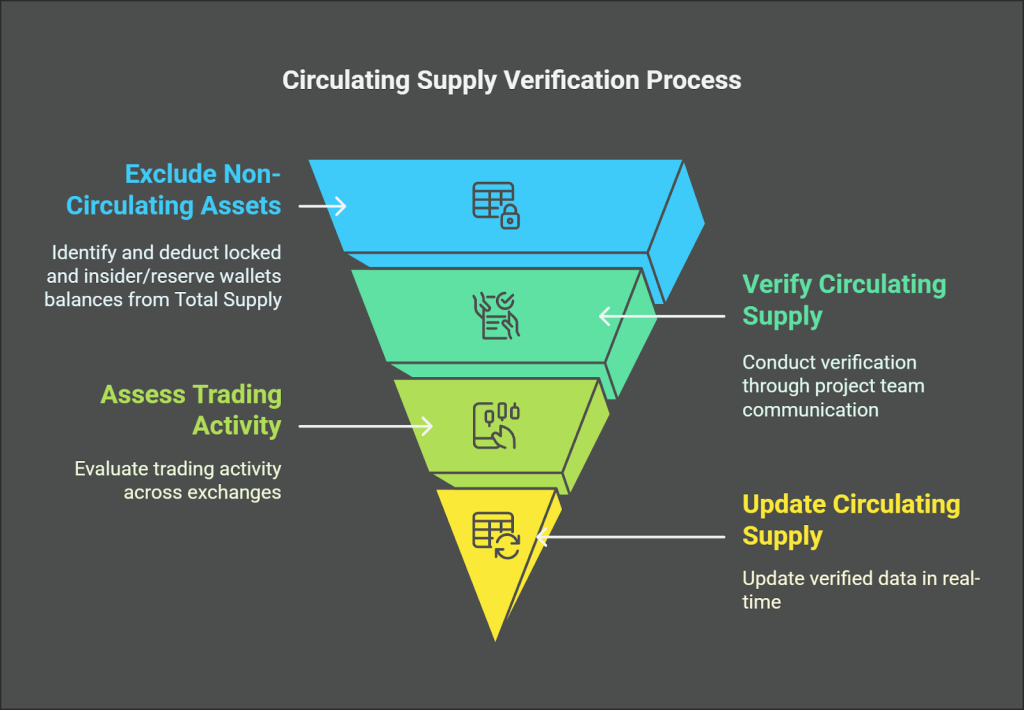

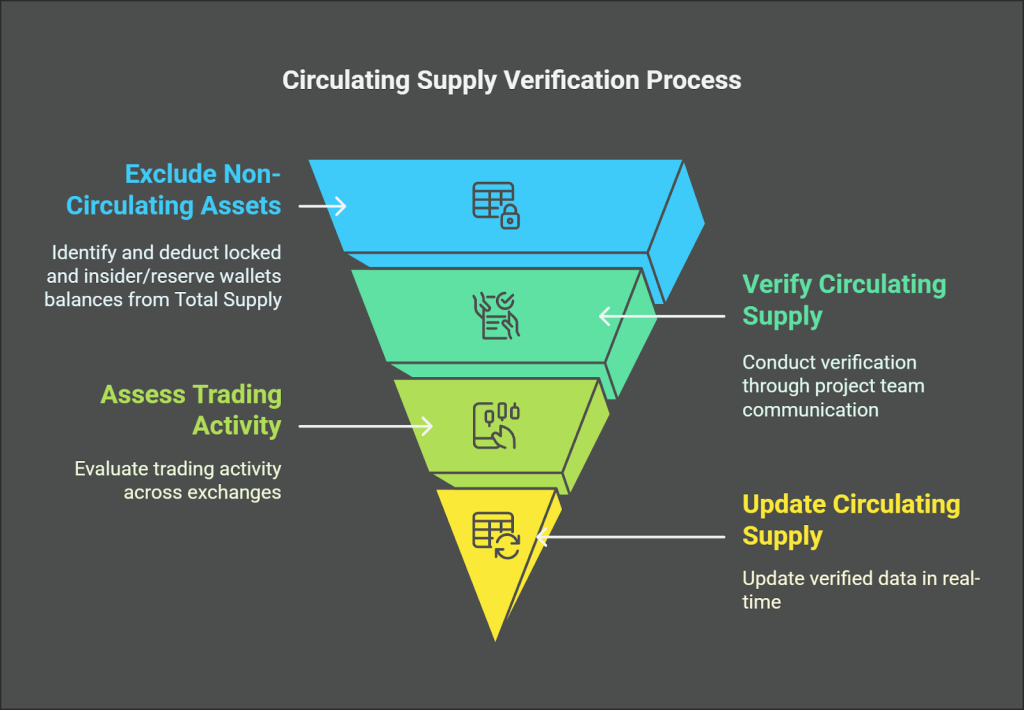

Circulating supply refers to the number of tokens that are currently available to the public and can be freely traded on the open market. This is the most important supply metric for short- and medium-term price analysis.

Market capitalization is calculated using circulating supply, not total or max supply:

Market Cap = Token Price × Circulating Supply

This means two tokens with the same price can have radically different valuations depending on how many tokens are circulating. A token priced at $1 with a 10 million circulating supply is fundamentally different from a token priced at $1 with 10 billion in circulation.

Circulating supply also determines real liquidity. If only a small fraction of tokens is circulating, price movements can be volatile and heavily influenced by future unlocks.

Total supply represents the total number of tokens that currently exist, excluding any tokens that have been permanently burned or destroyed.

Total supply answers the question: How many tokens exist right now?

Total supply provides insight into future inflation risk. If the circulating supply is significantly lower than the total supply, it means a large number of tokens may enter the market later. This often creates downward price pressure when unlocks occur.

Projects with aggressive emission schedules or long vesting periods can appear stable initially but experience dilution months or years after launch.

Max supply is the absolute maximum number of tokens that will ever exist for a given cryptocurrency. Once this limit is reached, no additional tokens can be created.

Max supply is primarily a theoretical upper bound rather than a practical short-term metric.

Some projects define a hard supply cap, creating a scarcity-driven narrative. Others use inflationary or semi-inflationary models to incentivize network participation.

Both approaches can be valid, depending on the use case, but misunderstanding them often leads to incorrect long-term assumptions.

These three metrics form a hierarchy:

However, the distance between them is where most analytical insights are found.

Understanding where a token sits within these scenarios is essential for realistic valuation.

Token unlocks occur when previously locked tokens become transferable and enter cthe irculating supply. These events are typically tied to:

When a large number of tokens unlock simultaneously, supply increases without a guaranteed increase in demand. This often results in:

Professional investors closely monitor unlock calendars to anticipate supply shocks.

Token burning permanently removes tokens from the supply by sending them to an irrecoverable address. This reduces total supply and, in some cases, max supply.

Burns reduce total supply and circulating supply simultaneously, creating deflationary pressure. However, burns only matter if they are significant relative to the overall supply and consistent over time.

Small burns used purely for marketing purposes rarely have a meaningful economic impact.

Inflationary models continuously increase total and circulating supply. These are often used to:

Such tokens rely on sustained demand to maintain price stability.

Deflationary models aim to reduce supply over time. This can support price appreciation, but only if the token retains utility and demand.

Supply reduction alone does not guarantee long-term value.

Based on circulating supply:

Market Cap = Price × Circulating Supply

This reflects current market conditions.

Based on max supply:

FDV = Price × Max Supply

FDV estimates the theoretical valuation if all tokens were in circulation.

FDV assumes full distribution at the current price, which is rarely realistic. However, a very high FDV compared to market cap can signal future dilution risk.

A healthy token economy typically shows a reasonable gap between market cap and FDV, aligned with transparent emission schedules.

One of the most frequent errors is focusing solely on the token price without considering supply size. A token priced at $0.01 is not inherently cheaper than one priced at $100.

Other common mistakes include:

Professional analysis always contextualizes price within supply dynamics.

Effective use of supply metrics involves combining them with:

Supply analysis should answer one core question: How will the availability of tokens change relative to demand over time?

If supply grows faster than demand, price pressure is inevitable. If demand grows faster than supply, appreciation becomes structurally possible.

Token supply mechanics are foundational to understanding cryptocurrency economics. Circulating supply determines current valuation, total supply reveals near- to mid-term dilution risk, and max supply defines long-term scarcity assumptions.

Ignoring these metrics leads to shallow analysis and poor decision-making. Properly understanding them allows investors, analysts, and builders to evaluate crypto assets with clarity, realism, and strategic depth.

In crypto, price tells a story—but supply explains whether that story is sustainable.

Related Topics

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See moreBlog

See more