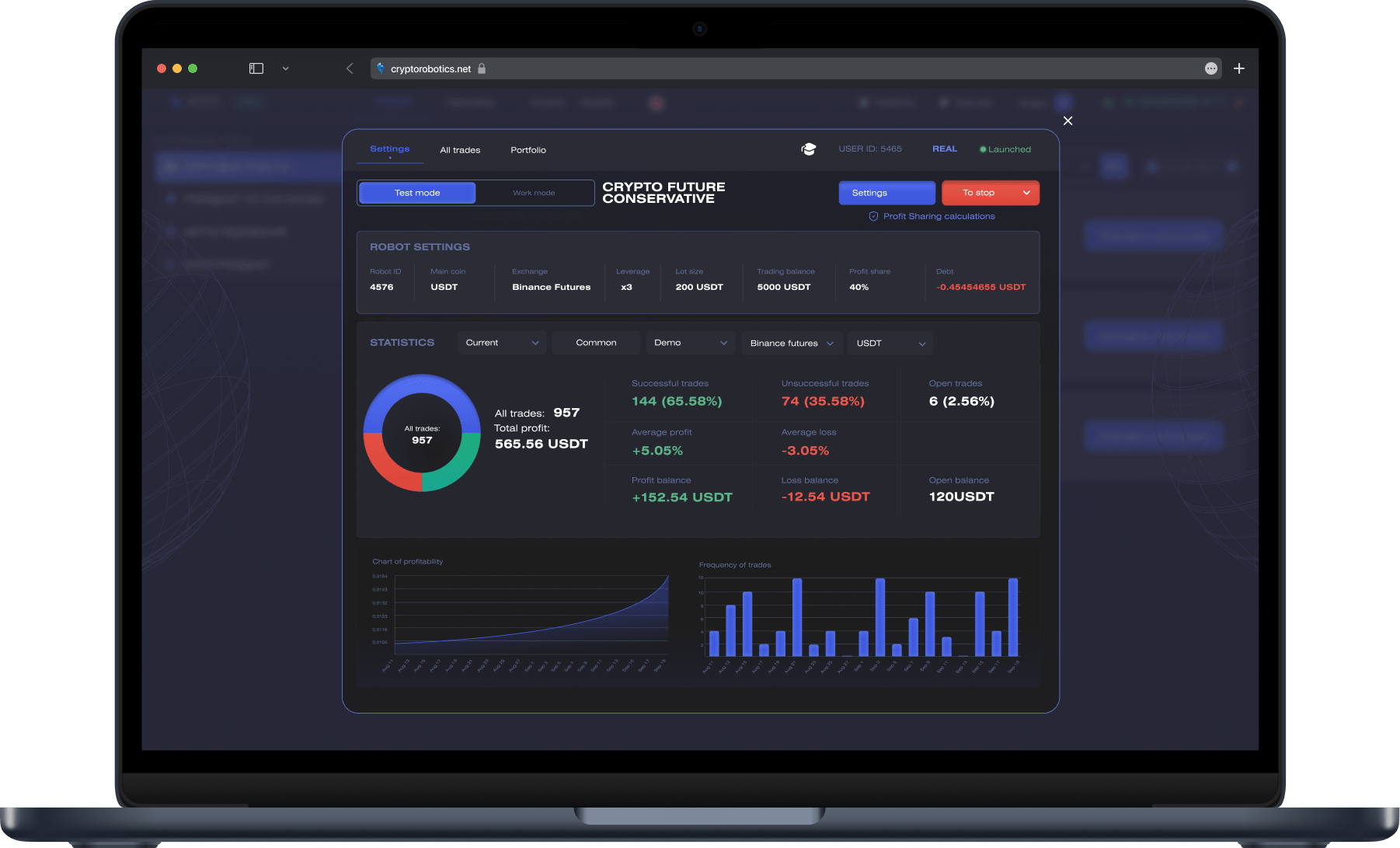

Crypto investment bots

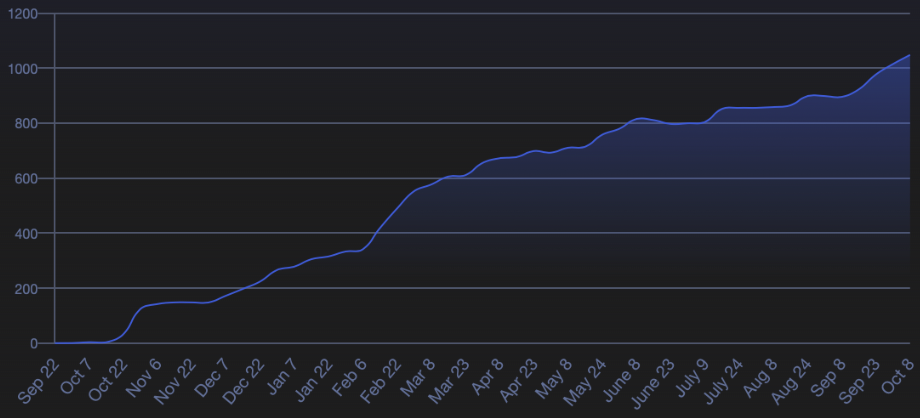

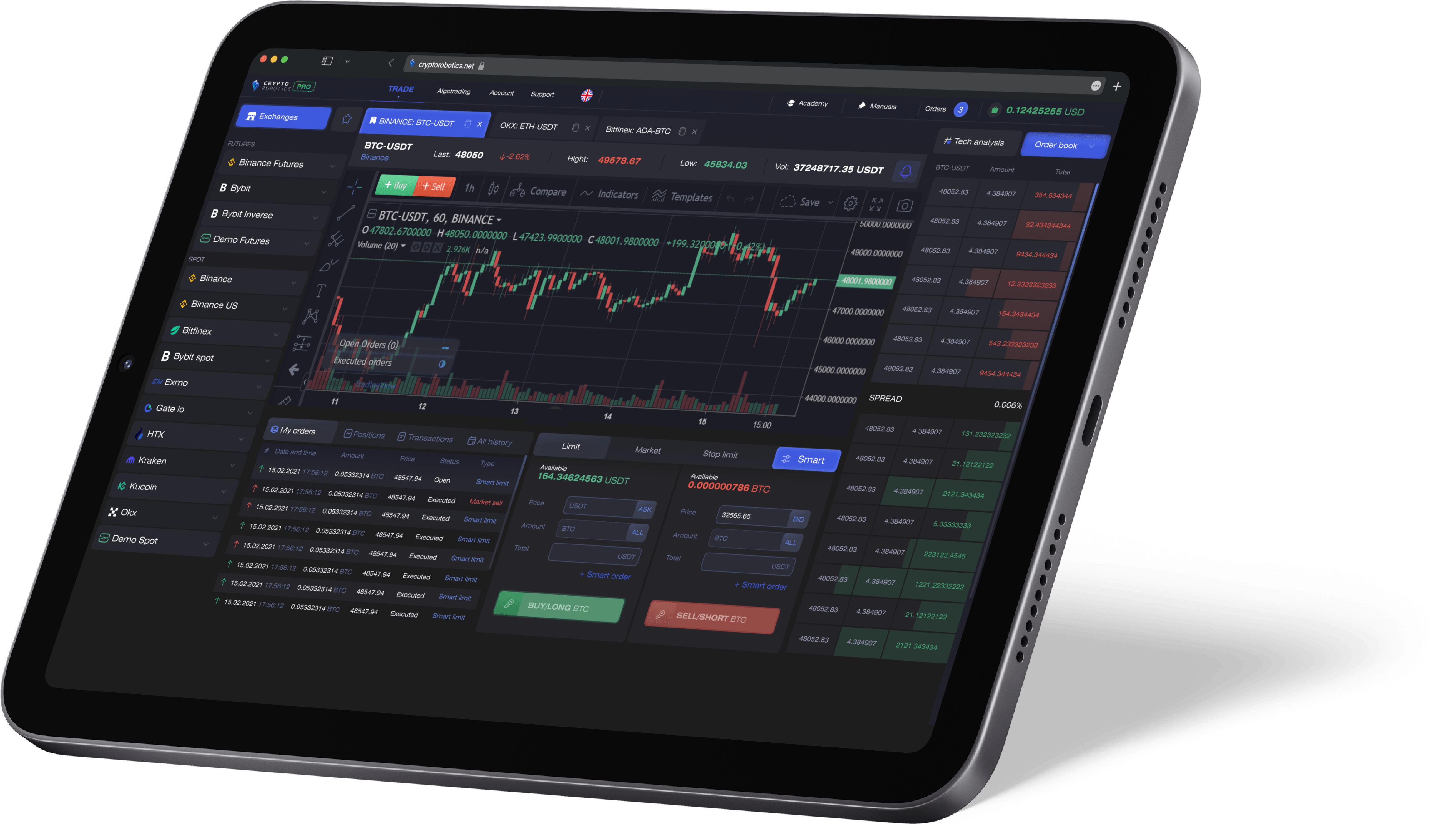

Binance, Binance Futures, Binance US

Followers

48

All trades

29,965

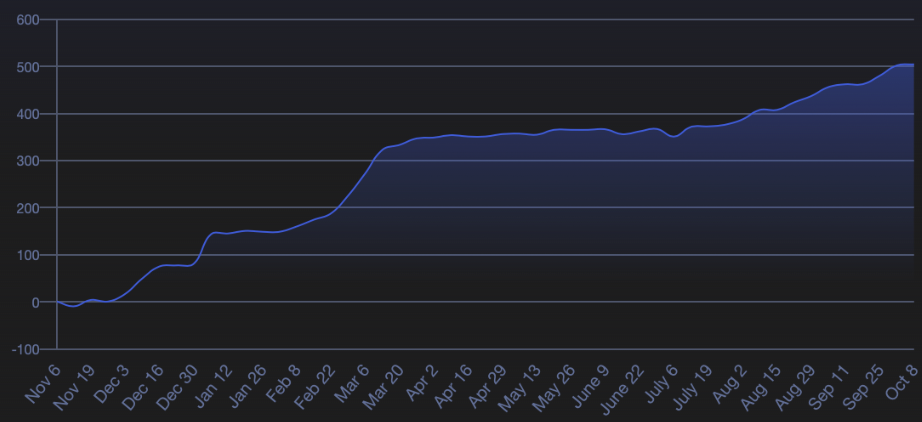

Total profit

133.65%

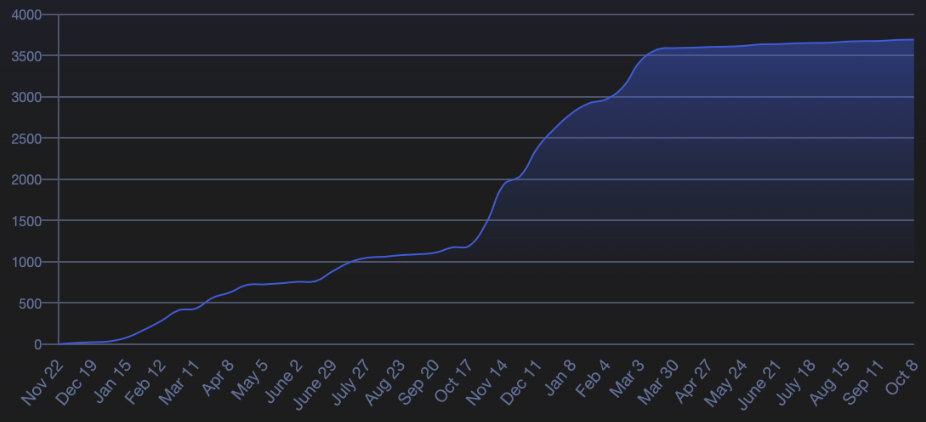

Binance

Followers

21

All trades

40,494

Total profit

85.33%

Binance, Demo Spot, XT

Followers

34

All trades

9988

Total profit

82.96%

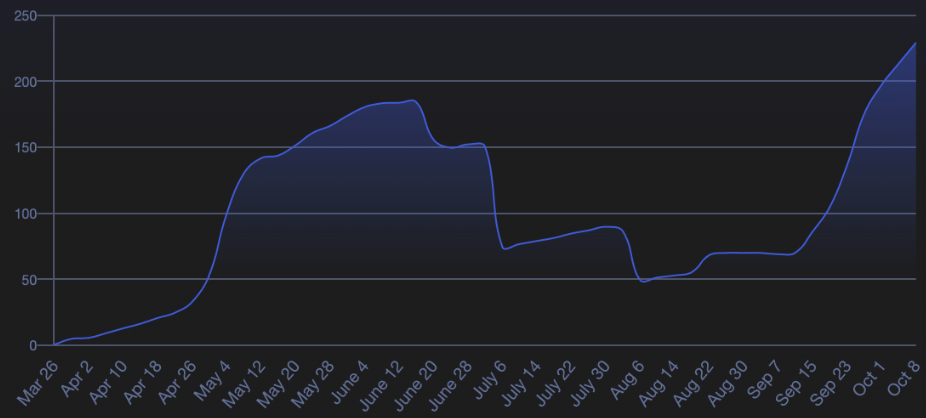

Bybit, Bybit Spot, HTX, KuCoin, OKX

Followers

29

All trades

336

Total profit

43.52%

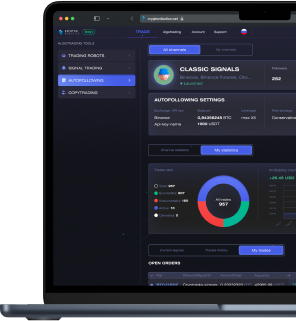

Discover Our Crypto investment bot

How Does It Work?

Buy&Hold Crypto With the Best Crypto Investment Bot

Use a Profit-Sharing Payment Model

Try Out Our Crypto Investment Bot on a Demo Exchange Today!

Boost Your Trading: Get Started with Our Automated Crypto Signal Provider

Choose Your Plan

Free

Basic PRO

Expert PRO

Mono Optimus:ALT/BTC or USDT, BTC/USDT

Mono CyberBot:ALT/BTC or USDT, BTC/USDT

Optimus:ALT/BTC or USDT, BTC/USDT

CyberBot:ALT/BTC, ALT/USDT or ETH

CryptoFuture:Conservative, Moderate, Risky

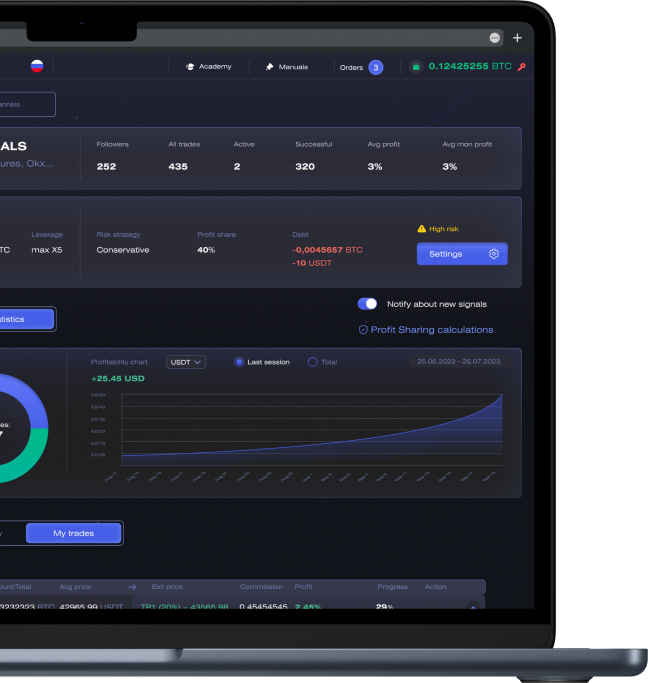

Signals PRO

Reviews

See moreAccess the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best Crypto investment bots directly from your smartphone or tablet.